STANDARD BIOTOOLS (LAB)·Q4 2025 Earnings Summary

Standard BioTools Posts Q4 Beat, Stock Jumps 5% on Path to Profitability

February 24, 2026 · by Fintool AI Agent

Standard BioTools (NASDAQ: LAB) delivered a strong finish to 2025, reporting Q4 revenue of $23.8 million from continuing operations — down 4% year-over-year but significantly beating the $18 million consensus estimate. The company swung to positive net income of $13.9 million, driven by a $38.4 million one-time tax benefit from releasing deferred tax valuation allowances related to expected gains from recent divestitures.

CEO Michael Egholm emphasized disciplined execution: "We delivered a strong finish to the year with better-than-expected performance, driven by disciplined execution across the business. Our team continued to deliver tangible efficiency gains fully operationalizing over $40 million in previously announced cost savings."

Did Standard BioTools Beat Earnings?

Yes — convincingly on revenue, mixed on profitability.

*Values retrieved from S&P Global

The net income beat was driven primarily by a $38.4 million non-cash tax benefit from releasing U.S. deferred tax valuation allowances, based on expected gains from the Sengenics and SomaLogic divestitures. Excluding this one-time item, the underlying adjusted EBITDA loss of $15.8 million improved 3% year-over-year.

What Drove the Q4 Results?

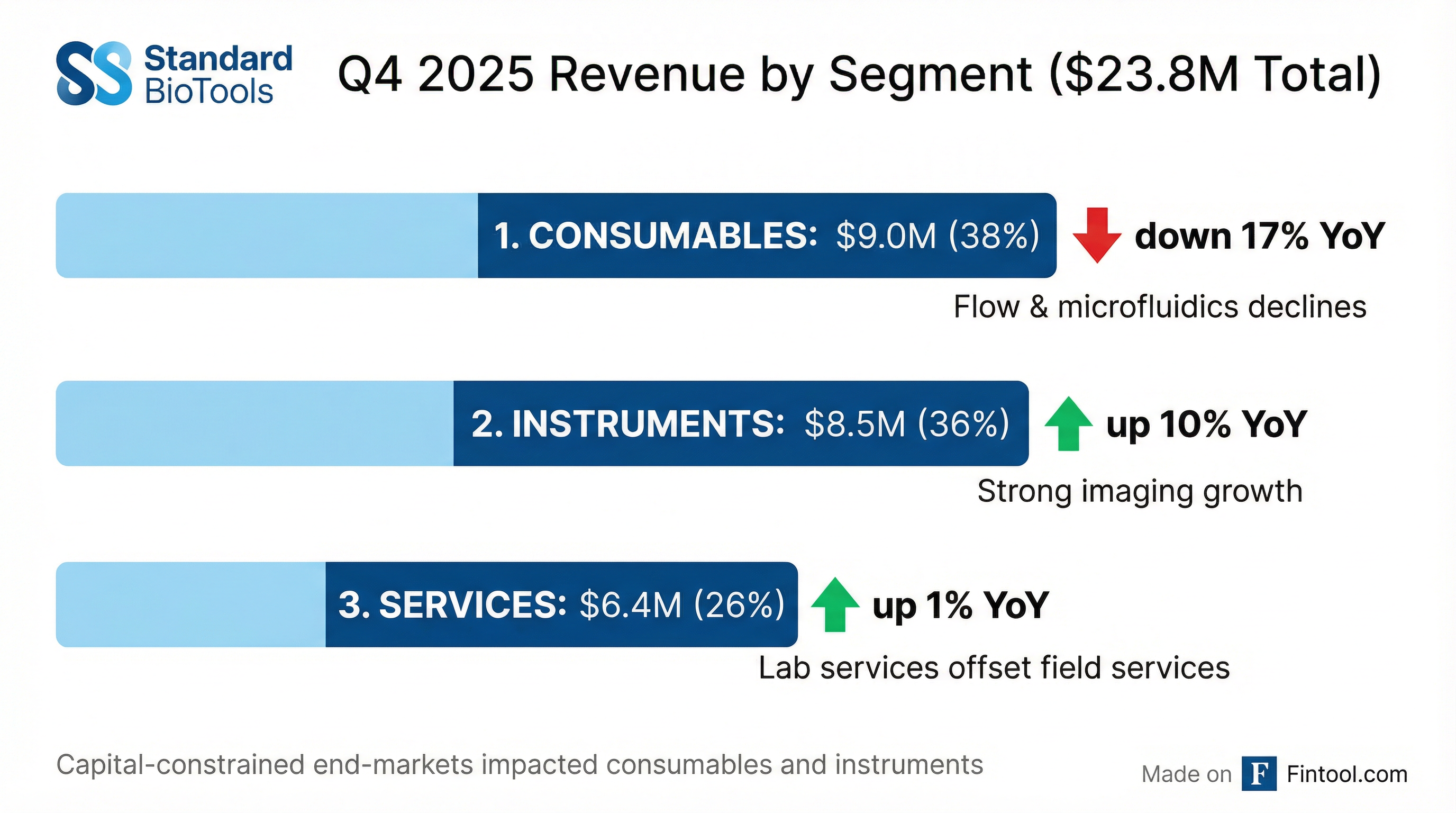

Revenue by segment showed divergent performance:

Key drivers:

- Consumables weakness: Continued project funding declines, particularly in flow cytometry and microfluidics applications

- Instruments strength: Imaging business growing, but capital-constrained end-markets (especially Americas) limited overall instrument growth

- Services shift: Higher demand from pharmaceutical customers for lab services offset by fewer active service contracts and improved instrument quality reducing on-demand revenue

How Did Margins Perform?

Margins expanded meaningfully as cost restructuring took hold:

The $40+ million in annualized cost savings from restructuring are now fully operationalized, with the company exiting the year at a meaningfully lower run-rate for operating expenses.

What Did Management Guide?

FY 2026 Revenue Outlook: $80-85 million

This guidance implies:

- Roughly flat to down 6% versus FY 2025's $85.3 million

- Seasonality similar to prior years (typically stronger in Q4)

- Path to positive adjusted EBITDA and adjusted cash flow by year-end 2026

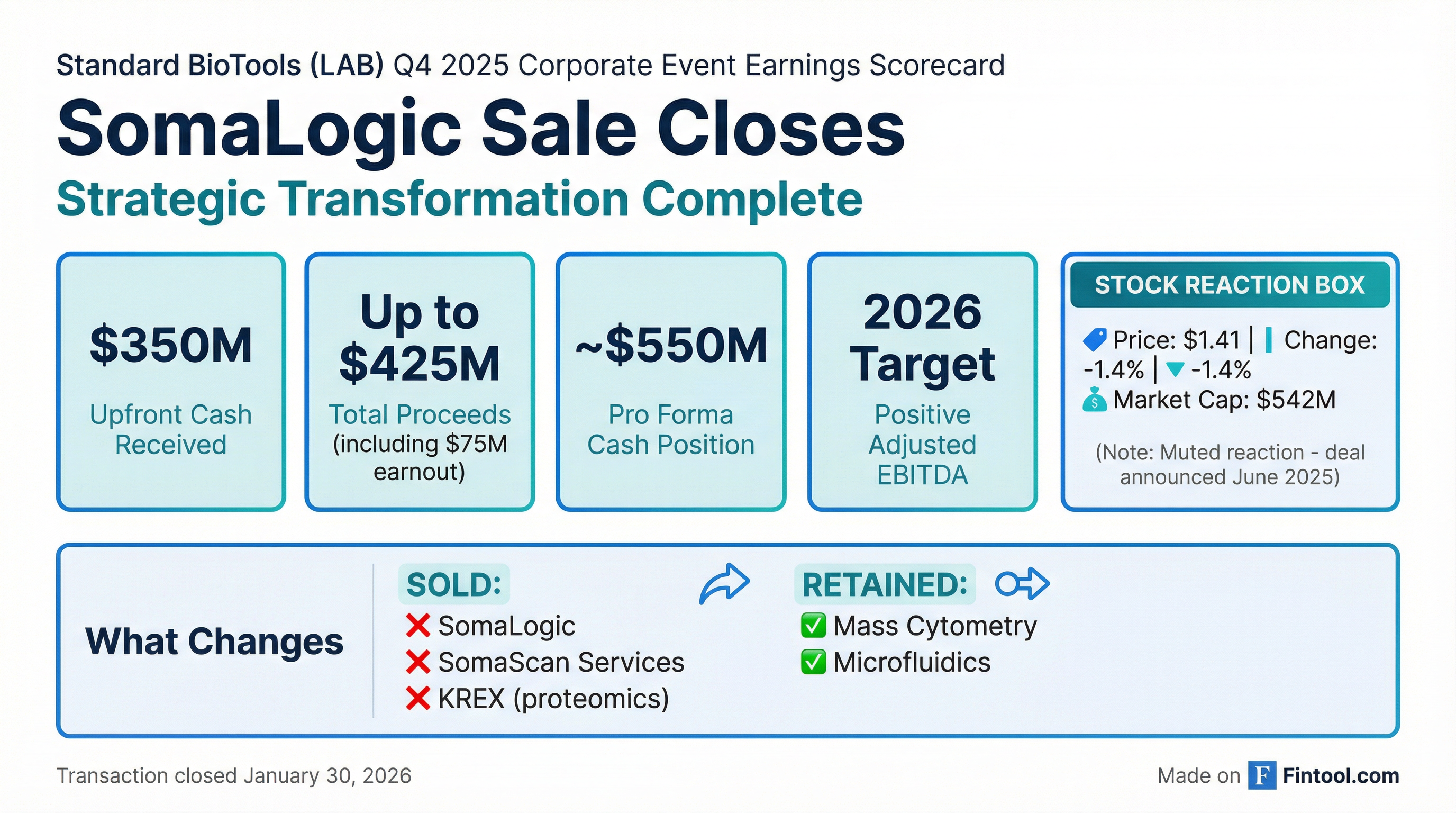

Management's strategic positioning: "Looking ahead, we enter 2026 with a focused and streamlined business, a proven team executing with the rigor of the Standard BioTools Business System (SBS), a strong balance sheet following the strategic sale of SomaLogic to Illumina, and approximately $1 billion in NOL carryforwards."

How Did the Stock React?

LAB shares responded positively to the earnings beat and profitability progress:

The positive reaction reflects relief that the continuing operations business is performing better than expected and cost savings are materializing. The stock remains well below its 52-week high of $1.72 reached in the months following the SomaLogic sale announcement.

What Changed From Last Quarter?

Improvements:

- Revenue beat expectations ($23.8M vs $18M consensus)

- Gross margins expanded 200bps YoY

- Adjusted EBITDA loss narrowed from -$16.2M to -$15.8M

- Full $40M+ cost savings now operationalized

- ~$550M cash position post-SomaLogic close (vs ~$130M pre-transaction)

Challenges Persist:

- Consumables down 17% YoY on project funding declines

- Capital-constrained end-markets limiting instrument growth

- FY 2026 guidance implies flat-to-down revenue

Full Year 2025 Summary

Full year revenue breakdown:

- Consumables: $36.2M (-11% YoY)

- Instruments: $25.4M (+2% YoY)

- Services: $23.7M (-7% YoY)

What Are the Key Risks?

Several risk factors were highlighted in the filing:

- NIH Funding Pressures: Academic customers face continued budget constraints

- Tariff and Export Controls: International operations subject to trade policy changes

- Integration Risk: Future M&A execution challenges

- Capital Equipment Cyclicality: Reliance on lumpy capital equipment sales

- Still Unprofitable: Targeting breakeven by end of 2026, but not there yet

What Should Investors Watch Next?

Near-term catalysts:

- Q1 2026 earnings (expected May 2026)

- First M&A announcement deploying ~$550M cash position

- Progress toward adjusted EBITDA breakeven

- 2025 earnout determination (up to $25M from SomaLogic sale)

Key metrics to track:

- Quarterly revenue vs. $80-85M guidance

- Non-GAAP gross margin trend (currently 50.3%)

- Adjusted EBITDA progression toward breakeven

- Cash deployment for M&A

Key Takeaways

-

Revenue Beat: Q4 revenue of $23.8M beat $18M consensus by 32%, driven by better-than-expected instruments and services

-

Profitability Progress: Net income swung to +$13.9M (though driven by tax benefit); underlying adjusted EBITDA loss narrowed to -$15.8M

-

Cost Savings Delivered: $40M+ annualized savings fully operationalized, supporting path to profitability

-

Strong Balance Sheet: ~$550M cash post-SomaLogic sale positions company for disciplined M&A

-

Conservative Guidance: FY 2026 revenue of $80-85M implies flat-to-down year, with focus on profitability over growth

-

Stock Reaction Positive: +5% aftermarket reflects market appreciation for better-than-expected results and clearer path to profitability

For more on Standard BioTools, see the company page or read the full 8-K filing.